The Best Insurance Policy Money Can't Buy

We have taken the true meaning The Mirriam Webster dictionary gives for insurance, from “a means of guaranteeing protection or safety,” to what they also define as “coverage by contract whereby one party undertakes to indemnify or guarantee another against loss by a specified contingency or peril.” (1) In my world, I want to be the main person guaranteeing my protection from illness, gum disease, and tooth decay. I feel that paying someone to defray costs of a problem that I could have prevented, although helpful, takes some of the onus of responsibility away.

In the past, there was no insurance. People did their best to avoid illness. Let’s take a look at tooth decay as an example. The way to prevent tooth decay is well-known to involve a diet of whole foods, including animal fats, and eliminating processed carbs and smoking. Our ancestors mostly did just that and had very little to no oral disease. There were no dentists because they were not needed. In the world of yesteryear, dentistry was unnecessary. Having a healthy mouth was a birthright. See the work of Weston A. Price for more details. He talks about how the introduction of processed foods brought about tooth decay and gum disease, and many other modern ailments such as obesity and diabetes. From the evidence presented by Dr. Price, it is evident that the best insurance against tooth decay and other diseases is to eat correctly.

Today, most of us eat foods lower in nutrients and higher in processed carbohydrates. We are inviting diseases of malnutrition, chronic inflammation, and illness when we choose to eat this way. Tooth decay is the most common disease known to humanity as a result. Because tooth decay is so prevalent, I recommend two cleanings with check-ups per year. This strategy may help to prevent tooth decay, especially when the dentist finds conditions that will lead to decline, and the patient is sufficiently motivated to change their home care routine and diet. The cost of preventing tooth decay in this instance is the price of a cleaning, an exam, and possibly some check-up x-rays. We will assign a theoretical cost basis of one point to this scenario, where, depending on where you live, could equal roughly $250-$300.

If a one-surface cavity develops, the cost is still about a single cost basis of $250-$300. If the patient neglects to get timely treatment, the decay may spread to include more surfaces of the tooth, bringing the cost up to 1.3 points. Not a huge increase, but still 30% higher. Once a cavity is large enough, a filling is no longer a viable option, necessitating a build-up and crown at 6.9 points, which is 690% higher than a simple one-surface restoration! I talk about crowns in this previous post.

Commonly, patients wait until pain develops. At this point, endodontic treatment (root canal) must be performed to save the tooth. The cost basis is now up to 11.8 points. Occasionally, the tooth decay spreads far below the gum-line, adding a procedure called a clinical crown lengthening. We are now at 17.5 points to save the tooth.

There is a point where there is insufficient tooth structure left to save a tooth. Removing and replacing a tooth with an implant is 18 points. Through procrastination, we have climbed the ladder of treatment modalities that ramps up to 18 times the cost to replace a tooth than to do a one-surface filling in it. A stitch in time saves 18, not 9. However, if conditions are conducive to cavity formation, there will usually be more than just one tooth that needs major treatment after long absences from the dental office. I routinely see patients with well over $10,000 worth of treatment required.

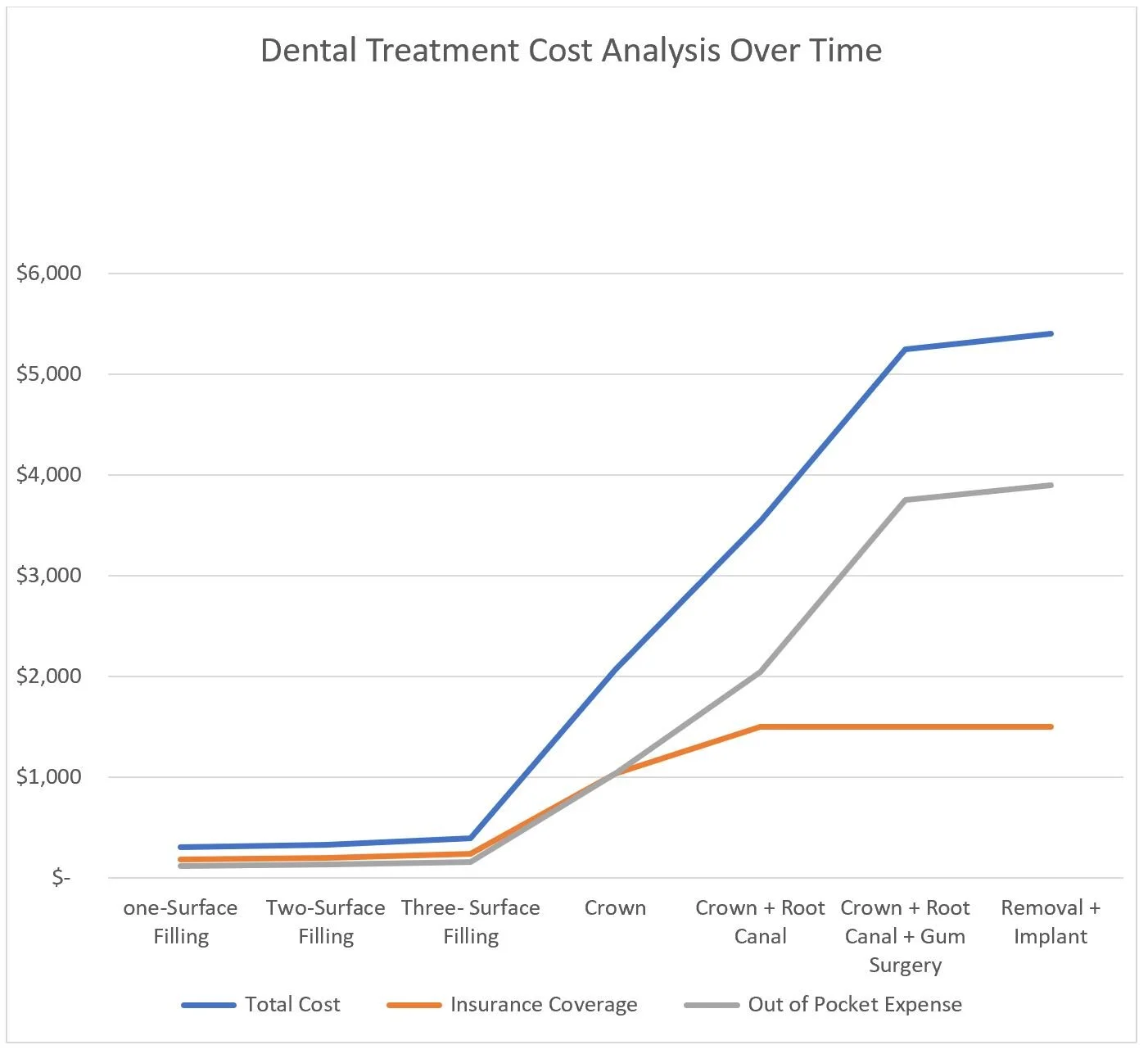

The table below shows the progression discussed above. I have added two real-world dollar estimates. I have also included a rough estimate of the out of pocket expense based on standard insurance coverage. The coverages are based on percentages of “usual, customary, and reasonable(UCR) fee schedules.” Some of the lower-end items like cleanings and simple fillings may be covered at 80%. The catch is that the amount covered is determined by the insurance and can be unusually lower than the going rate. The phrase usual, customary, and reasonable make it seem like the practice has exceptionally high fees when the reality is that the insurance has an unusually low allowable charge. The only thing that is usual, customary, and reasonable is the belief that the insurance company needs to make a profit based on unusual, unreasonable, and uncustomarily low fees.

An example is an average rate of $330 for a filling in a specific region of the country, but the insurance only pays 80% of their UCR of $150. In my example, a $330 filling is $220 out of pocket. There is another little trick where the insurance will downgrade the UCR, insisting that the dentist should place a cheaper mercury filling. I want to add that insurances vary quite radically from each other, but the coverage is usually no more than $1500 per calendar year. In the table below, after the insurance has agreed to pay $1500, the coverage for the year is done, and the balance is entirely out of pocket for the patient.

You can see how rapidly costs can get out of hand, especially after a filling is no longer an option. Patients and their providers are blind-sided by the differing UCR’s and percentages used. The prices I laid out today are cause for concern. The best insurance is a steady diet that contains the complete complement of nutrients while avoiding processed carbohydrates, your “means of guaranteeing protection or safety.” Bad stuff happens, though. People can have accidents and break teeth; it happens. I am not advocating abandoning insurance altogether. Although limited, it does help. I wanted to let you know the reality before disaster should befall you.

My final takeaway is that the best protection is lifestyle driven, not an indemnity plan.

If you are overdue for a cleaning and check-up, the longer you delay, the higher the costs may rise, so please schedule one today.